Navigating today’s speed of real estate so that you find the appropriate loans may feel like finding your way around a cave. Shoppers are often overwhelmed by dozens of choices and different rates and terms. This is where a mortgage broker society mortgage can come in, providing knowledge and customized solutions. But among mortgage broking, one name excels and that is Society Mortgage.

This article investigates the profession of mortgage broker society mortgage, namely Society Mortgage, their services, benefits and the value of the collaboration of a mortgage broker such as society mortgage in making well-informed financial decisions efficiently.

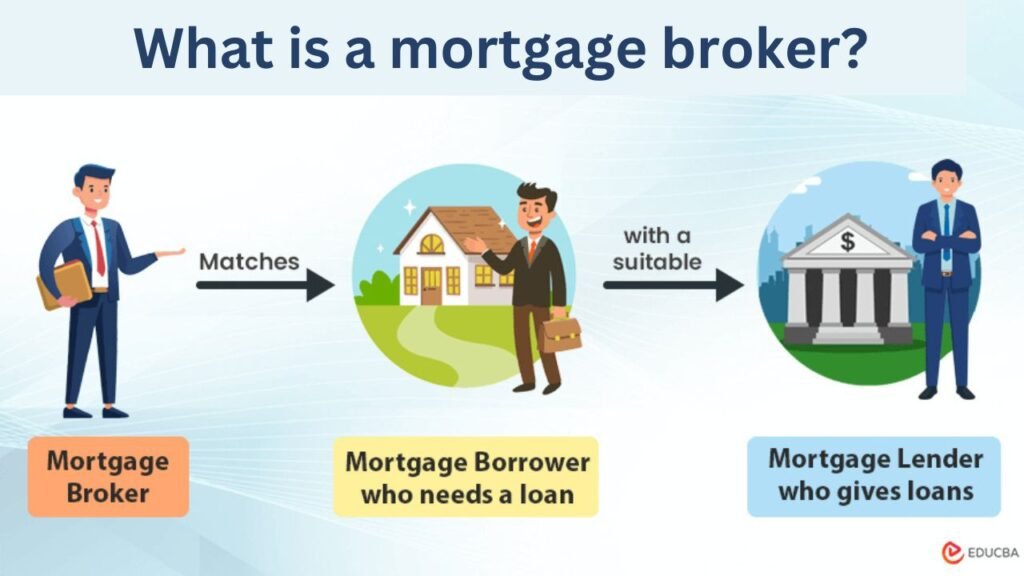

What is a mortgage broker?

A mortgage broker is a professional who acts as an intermediary between you, the borrower, and various lenders. The broker’s role is to help you find the best mortgage deal that suits your specific needs, preferences, and financial situation. They work with multiple lenders, ranging from traditional banks to private lenders, to offer you a variety of options. Brokers also help with the application process, gathering necessary documentation, and facilitating communication between you and the lender.

Unlike a loan officer at a bank, a mortgage broker has access to a broader range of mortgage products and lenders, giving you more options and a better chance of finding the best deal. Brokers can assist with several types of mortgages, including conventional loans, FHA loans, VA loans, and more.

The Role of Mortgage Broker Societies in the Mortgage Industry

Mortgage broker organizations are crucial in the regulation and enhancement of the mortgage industry through providing education, resources and support to mortgage brokers. If a person becomes a part of a society such as this then he must have to adapt to some certain resorts & at the same time has to be subject to strict code of code of ethics. This gives a level of safeguard to consumers that they are operating with specialists who watch out for their passions.

Main Duties of Mortgage Broker Societies:

- Education & Training: Mortgage broker associations offer continual training and continuing education for its associates. This way brokers always stay current on the most recent industry trends, laws, and online conditions.

- Advocacy and Representation: These organisations represent the interests of mortgage brokers and work with the Governments and the Industry bodies to formulate policies that would help in protecting both the consumers and the professionals in the mortgage industry.

- Consumer Protectioner: By establishing ethical standards and best practices, mortgage brokers societies holds brokers to operate provisionally and equitably and is accountable, which ultimately protects the consumer.

Why Choose a Mortgage Broker Society Mortgage?

When looking for a mortgage, dealing with a Mortgage Broker Society Mortgage comes with several benefits. Let’s look at some of the major advantages of having a mortgage broker who is a part of such an organization to deal with.

1. Loan Access to a Vast Majority of Lenders and Product

One of the greatest benefits of dealing with a mortgage broker is the ability to obtain a wide range of mortgage products and lenders. Of course any broker or consultant is not beholden to any one bank or lender, they can canvass many banks and offer you comparisons on that basis. A Mortgage Broker Society Mortgage gives you linkage to a broker however who may have associations with the multiple mortgage funding establishments Simply therefore, he can make you sure the very best of the price and conditions

2. Expert Guidance and Personalized Service

A Mortgage Broker Society Mortgage will give you professional guidance in a very complicated world of mortgage. Brokers who are members of these societies are very experienced and have a complete understanding of the current house market and all the lending terms. They are given the time to comprehend your financial position and present you with mortgage options that suit your needs. A personalized approach will save you time and money by leadings you to avoid common pitfalls and flaws.

3. Cost Savings and Better Rates

Are you should deal with a mortgage broker can save money on long run. Bancários tem acesso a vários financiadores, portanto têm uma probabilidade de obter taxas de juros baixos e boas condições melhor que você pode encontrar por conta própria. Brokers from Mortgage Broker Society Mortgage are paid to find you the business and they also may be offer special deals or that you won’t find anywhere else.

4. Streamlined Process

The mortgage application process can be lengthy, complicated and intimidating, albeit particularly so for first-time buyers. A Mortgage Broker Society Mortgage guarantees that you have an experienced expert there this every step in the process. They even aid in collecting the needed documentation, filling out the paperwork and the filing of your application to the right lenders. This level of service can greatly minimize the anxiety of obtaining a mortgage.

5. Consumer Protection

Few mortgage brokers that are part of Mortgage Broker Societies can be seen as buying and selling, as they adhere to a set of high ethical practices and strictly follow the regulation of the industry. This gives you the assurance of knowing your broker is functioning on your behalf. Besides, these societies usually provide means for resolving complaints or disputes which raises another safety layer for consumers.

Types of Mortgages Offered by Society Mortgage

Society Mortgage has an extensive variety of mortgage products, aiming at meeting the different conditions of its clients. These include:

1. Fixed-Rate Mortgages

A fixed-rate mortgage, is a very regular type of home mortgages. This loan has a fixed interest rate over the life of the loan thus giving you predictable payments each month. This type of mortgage is suitable for clients who like stability and predictability of payments.

2. Variable-Rate Mortgages (Adjustable-Rate Mortgages)

An adjustable-rate mortgage, also commonly known as a variable-rate mortgage, has a lower introductory interest rate that can vary at any time based on economic shifts. suitable clients for this type of mortgage are those who will sell or refinance the home before the rate increases, or that can handle monthly payments subject to possible changes.

3. FHA Loans

FHA loans are government-backed mortgages which are adapted to assist first-time homebuyers or people whom have a low credit score to obtain a loan. Typically, these loans involve reduced down payments and more lenient qualifications.

4. VA Loans

Veterans Affairs (VA) loans are lendable to military veterans and members of their families. VA loans come with several benefits including the possibility of having no down payment requirements, no private mortgage insurance (PMI) and cheap interest information.

5. Jumbo Loans

A jumbo loan is a kind of loan mortgage that surpasses the conforming loan limits as defined by the Federal Housing Finance Agency (FHFA) in the United States. They come in handy to buy expensive properties and their credit requirements are more rigorous.

6. Refinancing Mortgages

Refinancing is the process by which homeowners replace an existing mortgage loan with an new one to secure a better interest rate, or to make some other changes to the terms, like the length of time before it needs to be paid back. Society Mortgage brokers will also assist with the refinance process, helping homeowners to achieve the most suitable deal.

Mortgage Broker Society Mortgage vs. Traditional Bank Lenders

Many individuals might wonder whether it’s better to work directly with a bank for their mortgage rather than using a mortgage broker. Let’s compare the two options:

| Feature | Mortgage Broker Society Mortgage | Traditional Bank Lenders |

| Lender Options | Access to multiple lenders and a variety of mortgage products. | Limited to the bank’s own mortgage products. |

| Interest Rates | Potentially lower rates through broker relationships with multiple lenders. | Rates are fixed and may not be competitive compared to brokers. |

| Expert Advice | Personalized advice tailored to your financial situation. | Limited to the bank’s own offerings and may not be as personalized. |

| Speed of Process | Streamlined process with professional support at every step. | Process may be slower, as you are only dealing with one lender. |

| Flexibility | Brokers offer flexible options, including access to niche lenders and products. | Limited to the products offered by the bank. |

How to Choose the Right Mortgage Broker

Choosing the right mortgage broker is crucial to ensuring that you secure the best mortgage deal for your needs. Here are a few tips to help you make the right decision:

- Check their credentials: Ensure that the broker is a member of a recognized Mortgage Broker Society, which ensures they meet professional standards and adhere to ethical practices.

- Look for experience and expertise: Choose a broker who has experience working with a wide range of mortgage products and who understands your unique financial situation.

- Review client testimonials: Look for reviews or testimonials from previous clients to gauge the broker’s reputation and the quality of service they provide.

- Evaluate Their Communication Skills: A good mortgage broker should be approachable, communicative, and willing to explain the mortgage process in clear, simple terms.

Final Thoughts

Securing a mortgage is a significant financial decision, and having the right support is crucial to making an informed choice. Working with a Mortgage Broker Society Mortgage offers numerous advantages, including access to a wide range of lenders, expert advice, and potentially better rates. Whether you’re purchasing your first home or refinancing an existing mortgage, a professional mortgage broker can help you navigate the complexities of the process with ease.

Read Our More Blogs:-